Your Gift of Literacy Will Transform the Lives of Adults and Families in and around Delaware County, Pennsylvania.

Whether you donate online or send a check, your gift to the Delaware County Literacy Council (DCLC) helps local adults to gain the skills they need to get a job, keep a job, become citizens, read to their children, and take charge of their lives. Your donation is tax-deductible to the extent allowable by law.Give a Gift Online

Take action now to support adult literacy in our community. Your donation matters.Matching Gifts

Does your company match donations? Many employers offer matching gift programs to double the impact of their employees’ charitable contributions. Check with your HR department to see if your company participates.Give with Bing

Enroll in “Give with Bing” and money will be donated to DCLC each time you search the Internet using the Bing search engine. Get started here.Memorial Gifts

Spread the love and make a donation to DCLC in honor or memory of a loved one.Fundraisers

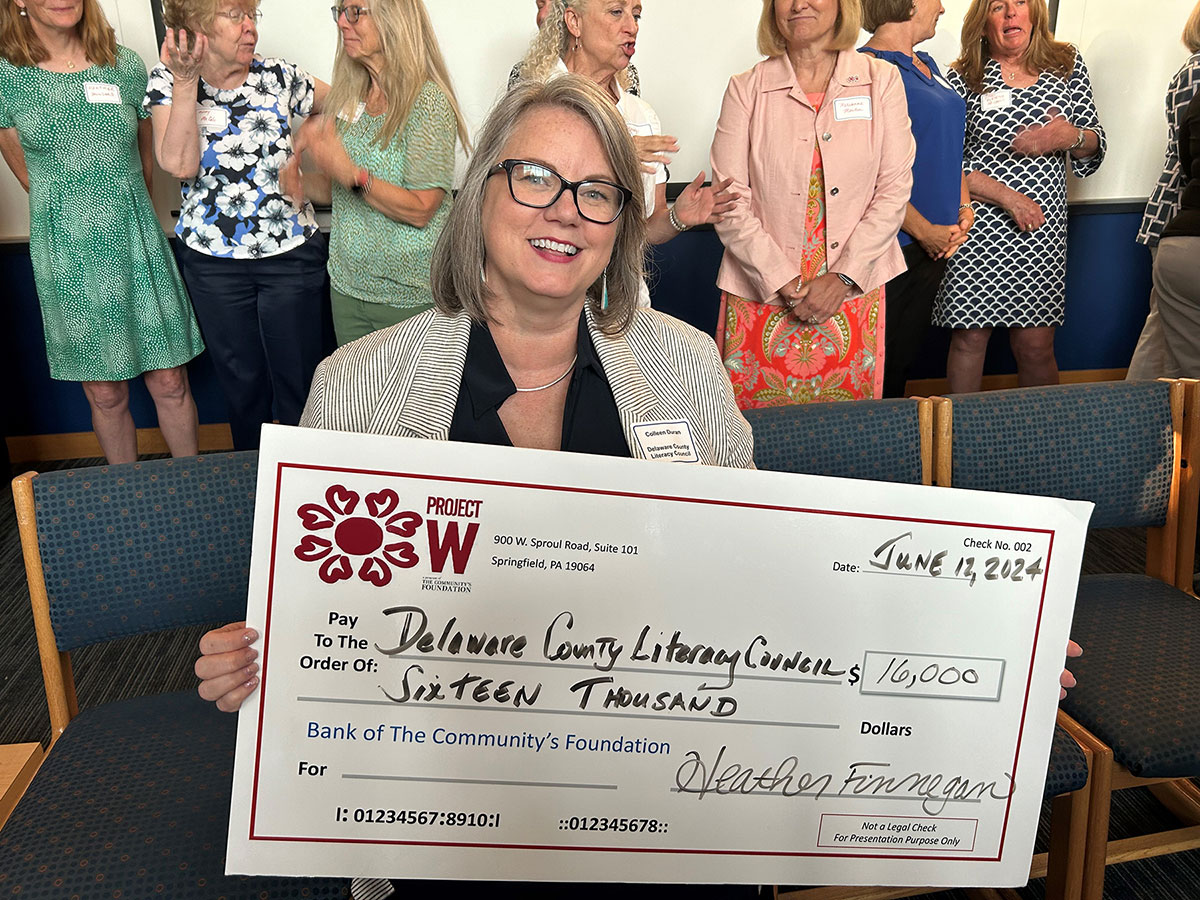

Fundraising plays a vital role in sustaining our efforts to promote adult literacy in Delaware County. Beyond traditional methods, we embrace digital fundraisers for occasions like birthdays, allowing our supporters to celebrate while making a meaningful contribution to our cause. Your participation in these events amplifies our impact, ensuring more individuals have access to essential literacy programs and services.Planned Giving

Planned giving offers various avenues for supporting our cause beyond traditional donations. Whether it’s including a gift in your will or trust, naming us as a beneficiary in your retirement account, establishing a donor-advised fund, or exploring charitable gift annuities, your planned gift ensures our mission continues for years to come. Additionally, gifts of stock or mutual funds and current gifts from your IRA provide unique opportunities to make a lasting impact on adult literacy in Delaware County.

A Special Opportunity for Those 70 1/2 Years Old and Older

Make a difference today and save on taxes. It is possible when you support DCLC through your IRA. You can give any amount (up to a maximum of $100,000) per year from your IRA directly to a qualified charity such as DCLC without having to pay income taxes on the money. Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference at DCLC. This gift option is commonly called the IRA charitable rollover, but you may also see it referred to as a qualified charitable distribution, or QCD for short.

Why Consider This Gift?

- Beginning in the year you turn 73, you can use your gift to satisfy all or part of all your required minimum distribution (RMD).

- You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

- Since the gift doesn’t count as income, it can reduce your annual income level. This may help lower your Medicare premiums and decrease the amount of Social Security that is subject to tax.

- Your gift will be put to use today, allowing you to see the difference your donation is making.